When I came to Japan after graduating, I was excited to be an adult. (Forget the fact that the JET program holds your hand all the way over to Japan.) I had my own apartment. I was getting paid a decent wage. I was a car owner. I was making omelettes for dinner every night. But with adulthood come great burdens. One of these, which I was somewhat excited to take on, is filing taxes.

Fortunately, the process is relatively simple for foreigners living abroad, and I found Shana West’s great website which explains everything. That page is here. It is extremely detailed and helpful, so I recommend using it, but I’ve summarized the process below and added a couple of details.

1. CHECK YOUR FINAL PAYCHECK OF THE YEAR!

In Japan, your final paycheck of the year will include your 源泉徴収票 (げんせんちょうしゅうひょう). This is proof of how much you earned and were taxed that year – the Japanese equivalent of a W-2. It’s a small piece of paper and easy to lose track of, so keep an eye out for it. If you do lose it, it shouldn’t be too difficult to get another copy printed at your local town/ward/city office. (On a side note, that word is so much fun to say. 源泉徴収票, heh.)

2. File Form 4868 by April 15.

In order to meet the requirements for exemption from U.S. taxes, you need to have lived in Japan for 330 days. JETs generally arrive at the end of July/beginning of August. Foreigners abroad automatically have a two month extension, but that isn’t always enough for first year expats. Filing Form 4868 gives you until October 15. So submit this form, and then just wait.

3. Turn your 源泉徴収票 into an English W-2.

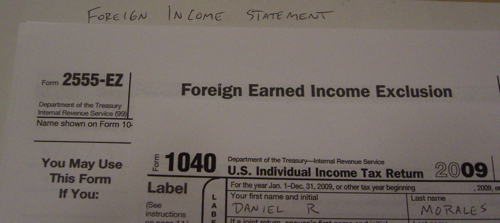

Because the 源泉徴収票 is in Japanese, you need to translate it for the IRS. I always copy it and then mark up the copy exactly as Shana says. At the top I write “FOREIGN INCOME STATEMENT.” I point out the Japanese calendar year “HEISEI 21 (JAPANESE CALENDAR YEAR) = 2009.” I show them my name in Japanese (although this year and last my name has been printed in English). And then I show them the amount paid: “AMOUNT PAID = X YEN x 1USD/93.68YEN = $Y.” I don’t notate the after taxes income, although it couldn’t hurt to point out that and then the amount you were taxed. That would kind of say “Shove it, you IRS tax monkeys. I’ve been paying my dues.”

At the bottom of the page I write (straight from Shana’s page): “Note: I used the 2009 average yen/USD exchange rate as reported by the Federal Reserve to calculate my income. That rate was 93.68 yen = $1.”

The Federal Reserve releases its annual exchange rates on January 1 every year. You can find them on their website.

4. Fill out Form 2555EZ and 1040 and send them along with your “translated” 源泉徴収票 to the IRS by October 15.

Form 2555EZ

This is the foreign income exemption form. The easiest residency test to pass is the “physical presence test.” Write the day you arrived in Japan and then a year from that date. From your second year onward these dates will always be 1/1 and 12/31. On the second page, note all the days that you were back in the U.S. (Remember, this is just the time back in the U.S., not the time you spent outside of Japan, so you don’t have to include that trip to Thailand – you JETs are all so predictable.)

Form 1040

This is the most annoying form. It’s only tricky if you have any earned income from the U.S. Follow Shana’s advice and fill out the form as you normally would, but include your Japanese income. This becomes significantly more simple your second year onward (at least it did for me) because you should have no earned income from the U.S.

I’m still not sure I’m filling it out properly. The one thing I do know is that I make significantly less than the $91,400 that you are allowed to claim as an exemption. My strategy is to just write “0” for any category I’m unsure of and then my Japanese income in parentheses for the “Other income” line.

And you’re done! Send that shit in and crack the beers!

A couple of notes:

– I didn’t fill out Form 8802 that Shana lists on her site. I was a CIR and was technically not able to get exemption from the Japanese taxes. Or so I thought. It was my understanding that the taxes would be deducted from my check and then given back to me in the form of a slightly higher salary. Wrong. I think I could’ve filed these forms if I tried. Oh well. Definitely get on that if you’re a JET.

– Some of my friends haven’t filed for several years and are worried that this will affect them somehow. I wouldn’t worry about it too much. Yes, you’re supposed to be filing them, but it’s not like you’re making a huge amount of money and embezzling it. And you actually are paying taxes. That said, if you are going to be moving home anytime soon (especially if you’re going for school), I’d try to at least get at least the most recent year filed. The good news is that you can ignore Step 2 if you’ve been here for over a year.

No excuses this year! You’ve got two sets of detailed instructions – the ones here and then Shana’s site – to help you through the process. がんばれ!